California’s largest public pension system has recorded a stunning 71% loss on a nearly half-billion-dollar clean-energy investment, underscoring the risks of politically driven finance and opaque private-equity ventures.

According to state filings, the California Public Employees’ Retirement System (CalPERS) poured $468 million into a private equity fund dedicated to clean energy and technology in 2007. As of early 2025, that investment has dwindled to just $138 million — a shortfall exceeding $330 million. With CalPERS pensions only 79% funded, independent analysts estimate an overall gap of $180 billion — a liability taxpayers could ultimately be asked to fill, writes The Center Square.

Last year, CalPERS reported a total return of 11.6%, with private equity yielding 14.3% versus 16.8% from public equities. That comparison left public-finance expert Marc Joffe of the California Policy Center skeptical. “Returns were similar … so why go through all the trouble — if you can get these kinds of returns on the public markets, why bother with all the complexities and the illiquidity involved in private equity?” Joffe asked.

He went further, warning that the pension fund’s losses reveal “the combined dangers of private equity and ESG investment — you have a very opaque investment choice that appears to have been chosen because of its green credentials, and yet it’s now generated a huge loss for taxpayers and retirees.” In his view, “CalPERS would be better off focusing on a diverse portfolio of publicly traded equities to get better long-term returns.”

The revelation comes as billionaire Bill Gates, a staunch supporter of “green” energy has all but admitted that the panic over global warming is mostly a hoax used to scare people.

CalPERS spokesman Abram Arredondo defended the strategy to The Center Square, saying the fund’s origins trace back to a different management era. “The CalPERS Clean Energy & Technology Fund dates back to 2007, before the pension fund’s board and staff worked together to tightly focus our private equity strategy,” he said. Since then, he added, the fund has “diversified our investments to reduce risk, selected the highest performing asset managers and lowered fees by entering into co-investments. Since that time [2022], we have reduced fees by 10 percent.” Arredondo noted that private equity “has been our best performer for the past 20 years and we believe our members deserve access to its income-producing opportunities.”

Despite those assurances, the fund still paid at least $22 million in management fees. CalPERS has boosted its private-equity target allocation from 7% in 2021 to 17% in 2024, even as critics warn that valuations in this arena rely on internal estimates rather than real-time market prices — a practice that can exaggerate gains.

Transparency advocates have raised red flags about the lack of disclosure. CalPERS denied most public-records requests about the investment, citing state exemptions for alternative assets. “The public should have a right to know how public money is being invested,” said David Loy of the First Amendment Coalition. “This is a serious transparency concern if the public doesn’t have visibility into how public money, especially pension funds, are being invested and to what degree of risk.”

Had the original $468 million been placed in an S&P 500 index fund with dividends reinvested, analysts estimate it would now be worth roughly $3 billion. The fund’s steep losses reflect the same era that saw high-profile solar failures such as Solyndra and Evergreen Solar, casualties of Chinese market dominance and evaporating subsidies.

CalPERS insists its new safeguards will prevent future missteps. But with billions at stake and opacity still shrouding the fund’s performance, taxpayers and retirees may remain uneasy about whether California’s green gamble has become a cautionary tale.

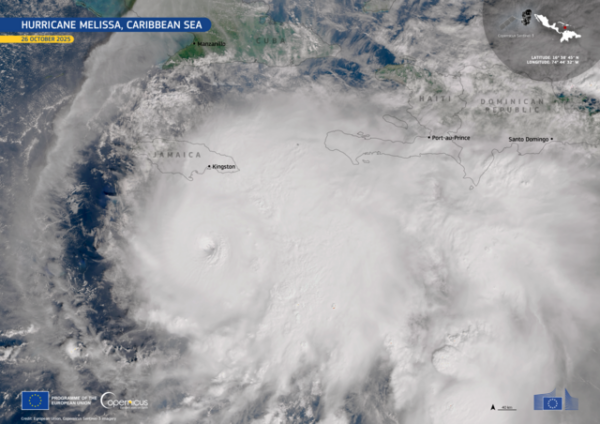

[Read More: Military Forced To Move Out Of Caribbean]

Were still sinking now under Newscum

Does Zero for CA

& we host the 2028 Games?

See the LA fires from 1-25